Best Credit Card Combo to Travel With Points: How to Use Credit Card Points for Travel and Hotels

Travel reward points feel confusing for a reason.

Most women are handed puzzle pieces — credit card points, airline miles, hotel rewards — without ever being shown the full picture. We’re told to “earn points,” but almost no one explains how to actually turn those points into real family vacations that cover flights and hotels.

And that’s where things fall apart.

In this guide, I’m walking you through exactly what happens after you earn the points, using a real-world example of an average family of five turning everyday spending into an international trip. No extreme strategies. No risky tactics. No living on credit.

Just a simple, repeatable system that works year after year.

Why Credit Card Points Feel So Confusing

Most people are already earning points just by living their normal lives — groceries, dining, gas, activities, subscriptions.

The problem isn’t earning.

The problem is not knowing what to do next.

Without a clear system, points start to feel:

-

Random

-

Overwhelming

-

Underwhelming when redeemed

-

Like they “only cover one flight”

And when that happens, people give up — or worse, redeem their points for low-value options that barely move the needle.

The 3 Rules Every Points Strategy Must Follow

Before we talk about the best credit card combo to travel with points, you need to understand the foundation.

Every successful points strategy must do three things well:

1. Earn Points Strategically

Not all spending earns points equally. The right cards earn more points on everyday categories like groceries and dining — without changing your budget.

2. Store Points Flexibly

Points should live in programs that give you options, not restrictions. This is where many people go wrong by locking themselves into co-branded cards too early.

3. Redeem Points for Maximum Value

This is where the magic happens — and where most people lose value.

Once you understand how these three pieces work together, the confusion disappears.

Real Example: Turning 267,000 Points Into a Family Vacation

To make this tangible, let’s look at a real scenario.

In my video series, we follow Family B — an average American family of five. Using U.S. Census data and normal spending categories, we applied a simple two-card strategy to their existing budget.

No extra spending. No lifestyle changes.

Result?

👉 267,000 credit card points earned in their first year — and every year after that.

That’s the key mindset shift most people miss:

This isn’t a one-time win. It’s an annual system.

How to Use Credit Card Points for Travel and Hotels (The Right Way)

Once the points are earned, the next step is knowing how to redeem them strategically.

Instead of shopping for flights by cash price, we shop by award availability and point value.

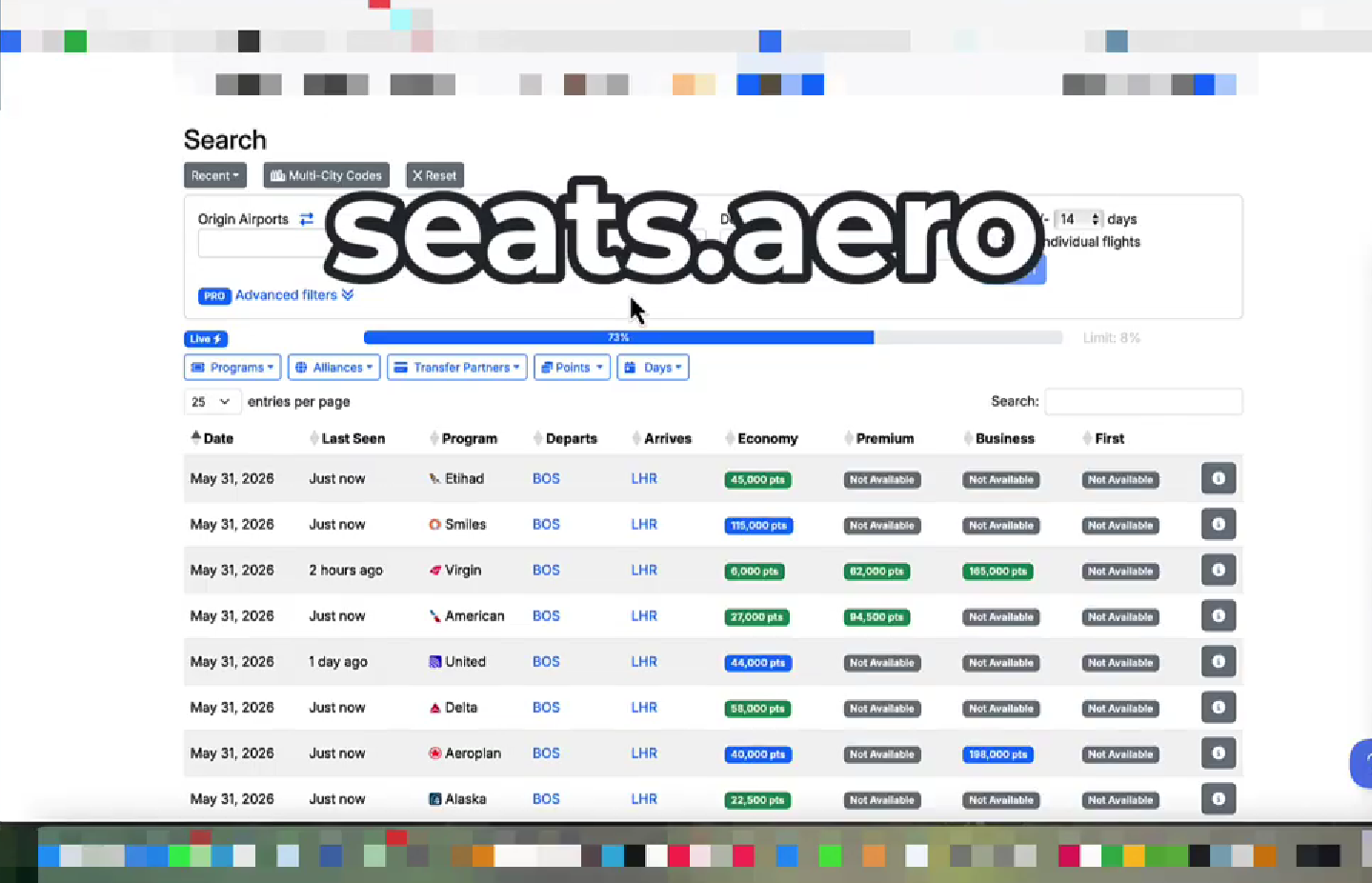

Searching Flights the Smart Way

Using award search tools, we can see:

-

Which airlines have availability

-

How many seats are open (critical for families)

-

Which routes offer the best point value

For example, we found:

-

Boston → London for 6,000 points per person, one-way

-

Direct flights

-

Major international airlines

Even better? Transfer bonuses reduced the actual cost even further.

How Transfer Bonuses Stretch Points Even Further

This is why flexible points matter.

Because Family B earned points through transferable credit cards (not airline-locked cards), they were able to take advantage of a 40% transfer bonus.

That means:

-

6,000-point flights became ~4,300 points

-

12,000-point return flights became ~8,600 points

👉 Total round-trip cost: 12,900 points per person

For a family of five?

64,500 points covered all flights to Europe.

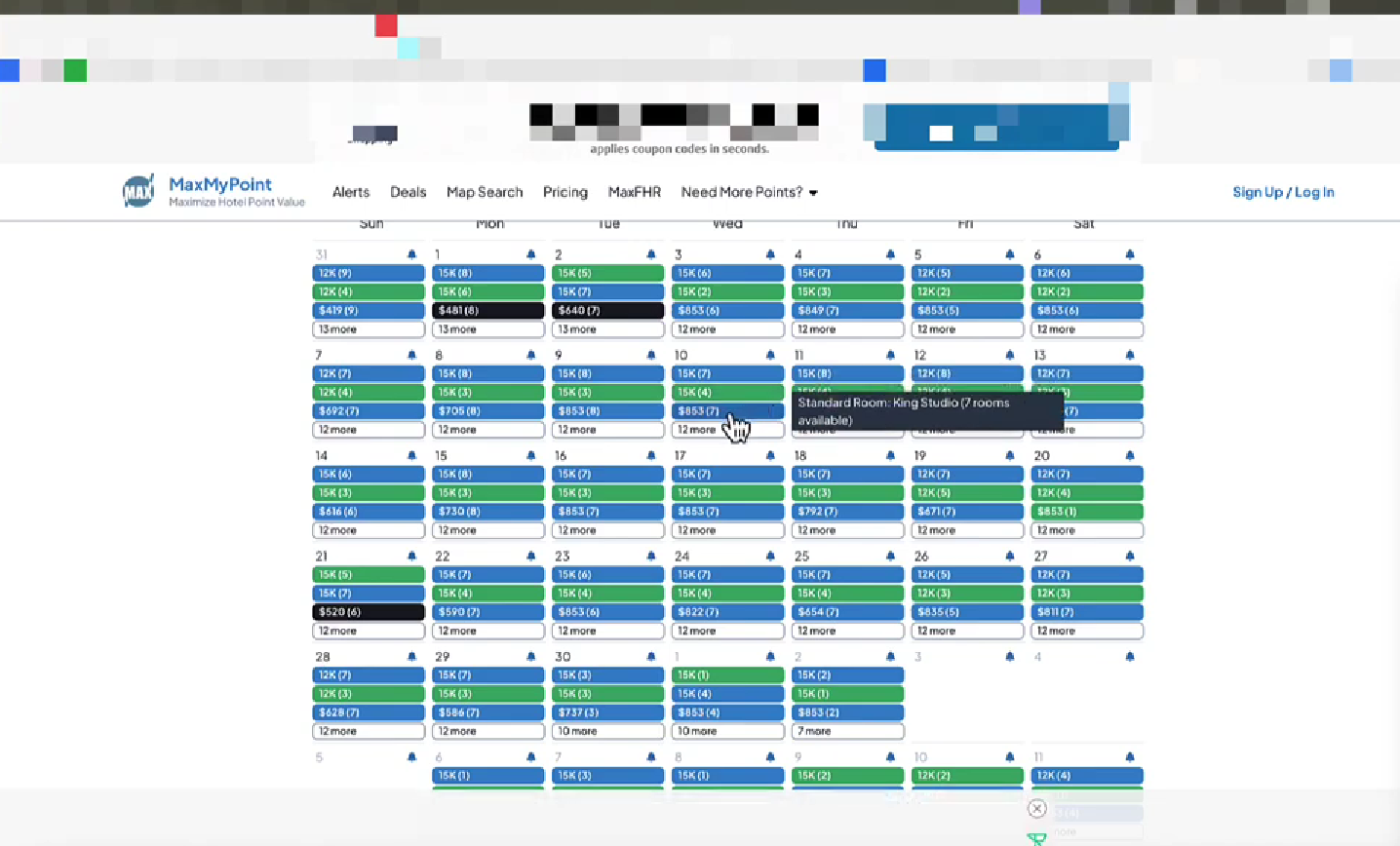

Booking Hotels With Points (Without Sacrificing Comfort)

Flights are only half the equation.

The same strategy applies to hotels.

By searching hotels by points value instead of nightly cash rate, we found luxury properties costing:

-

$600–$850 per night

-

Available for ~15,000 points per night

-

Reduced to ~8,800 points per night with a transfer bonus

These are hotels that would normally feel “off-limits” — except they’re fully covered with points.

Why This System Works Year After Year

This isn’t about hacking travel.

It’s about:

-

Running your existing budget through the right cards

-

Keeping points flexible

-

Redeeming intentionally

Family B didn’t change how they live — they changed how their spending works for them.

And once the system is in place, it repeats every single year.

Want to See This Booked in Real Time?

In the next video, I take this one step further.

I walk through a real booking — start to finish — and show how I booked a round-trip flight to Paris for $12 using points.

No theory. No estimates. Just the actual process.

👉 Watch the next video here: Your Neighbors Are Traveling Free (Here's Why) How I Score Free Trips for a Family of 5

Want the Full System Laid Out Simply?

If you want the best credit card combo to travel with points clearly mapped out — including:

-

Which cards to start with

-

How to structure your spending

-

Where your points should live

-

How to avoid low-value mistakes

That’s exactly why I created the Reward Travel Starter System.

👉 To learn more about the cards in this article and my other top recommendations, Get the Reward Travel Starter System here!

It’s the same framework I use to plan international trips for my family — without overwhelm, extremes, or guesswork.